Real Estate Market Update - February 2023

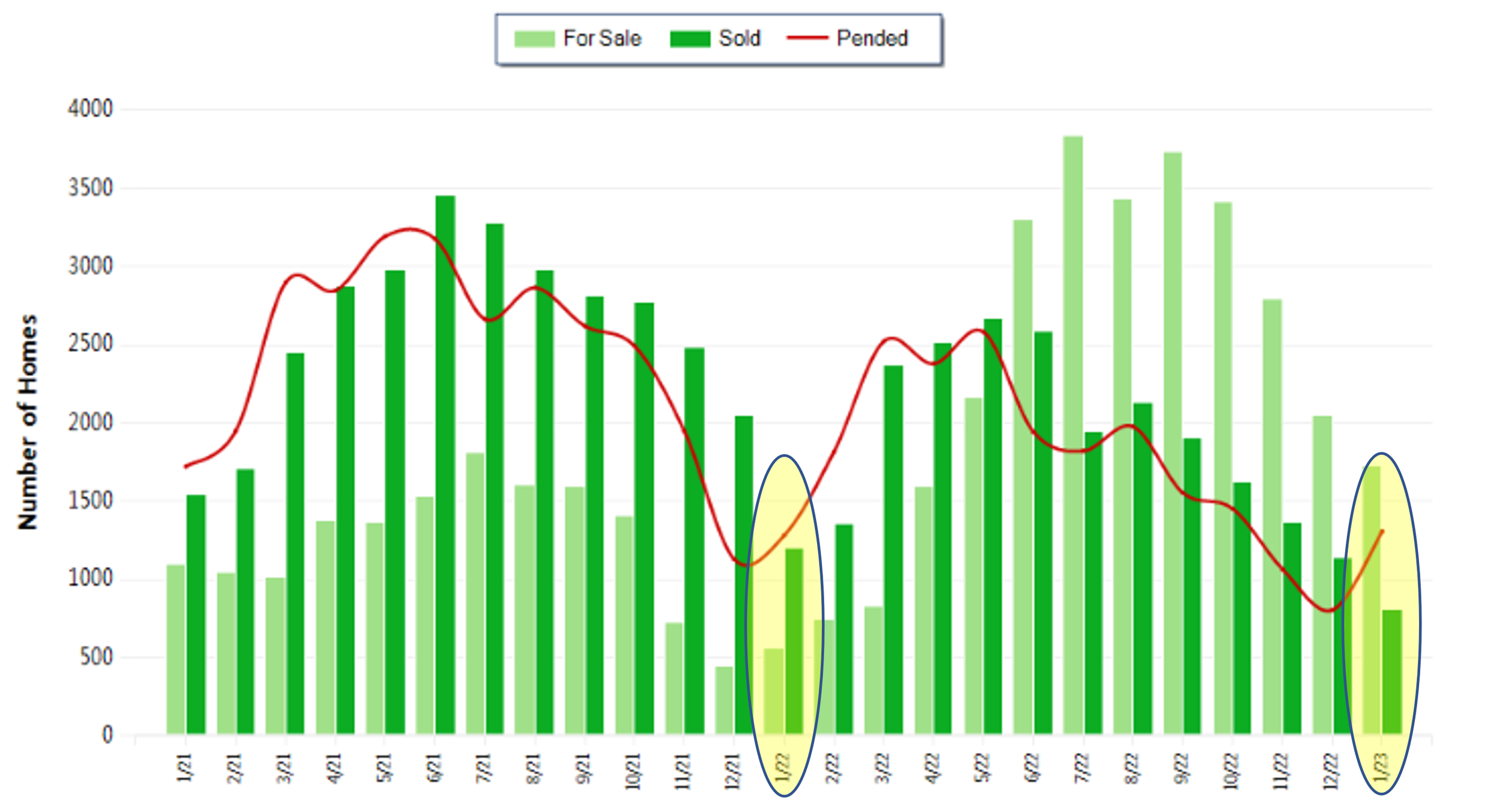

The greater Seattle-Bellevue real estate market of 2023 began with strong Buyer activity in January. The quantity of single-family properties in King County going under contract (demand) in January 2022 (1,282) increased 2% in January 2023 (1,308).

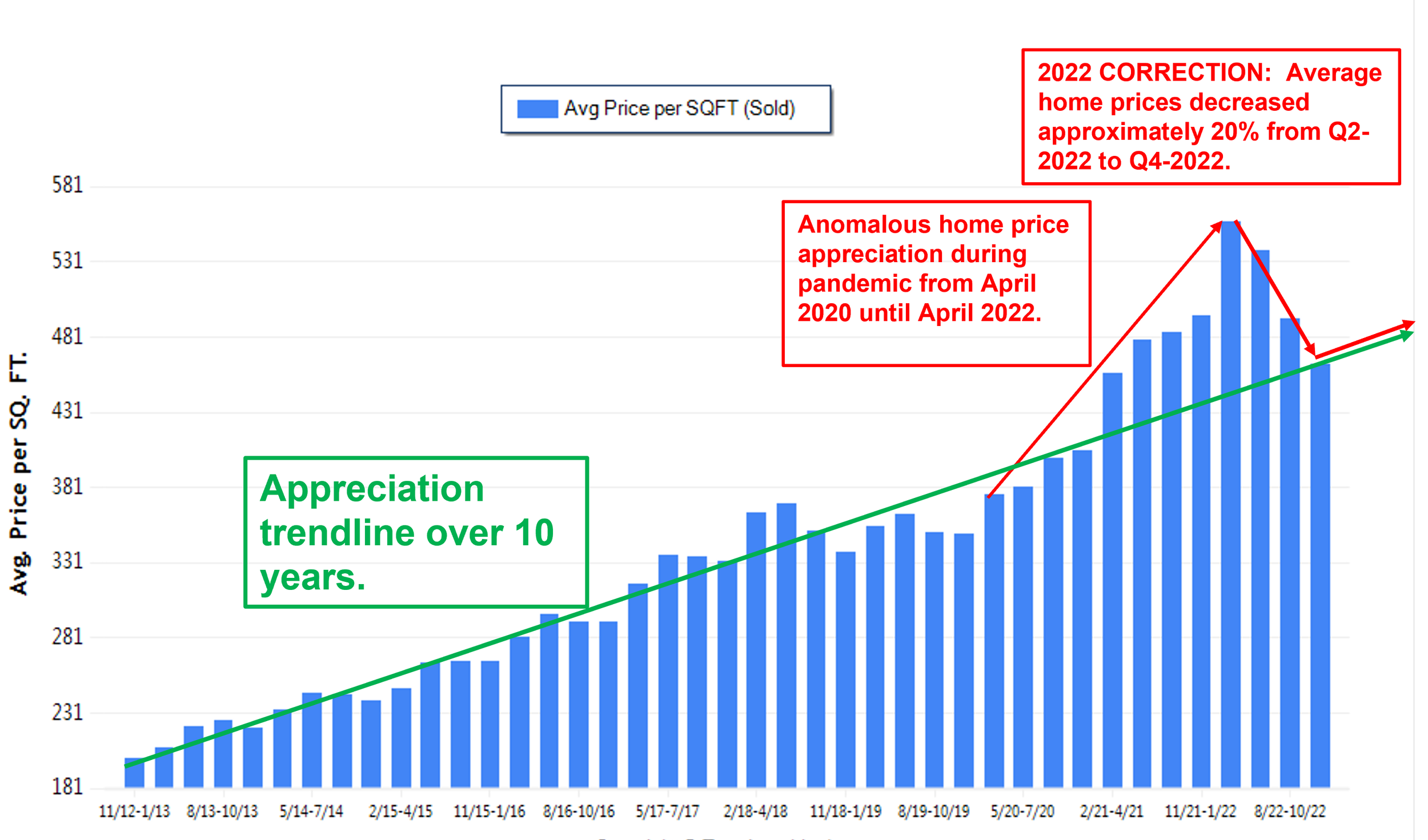

As previously reported, Q1-2022 may have been the strongest Sellers’ market of record. The average sold price for single-family properties in King County was $1,031,000 in January 2022 and peaked at $1,284,000 in April 2022, which is a 24.5% increase. However, after the 20% price correction from Q2-2022 to Q4 2022, the average single-family home is approximately $1,020,000 in January 2023. Based on current market dynamics and seasonal trends, I believe property values are at the trough of the dip and will begin to gradually increase (appreciate) until June.

The quantity of homes for sale (supply) increased over 210% from January 2022 (556) to January 2023 (1,728) while the average days on market increased from 17 to 51, respectively. Currently, there are some great deals for Buyers on the market. They appear stagnant and you often hear, “What’s wrong with this place?” The answer is likely it was listed during Q2-2022 to Q4-2022 and was overpriced.

For example, there’s a central Seattle property that was listed in July 2022 for $1,200,000 and is currently listed at $1,050,000, which is a 12.5% decrease. King County assessed the property at $1,019,000 in 2022 and $1,119,000 in 2023. Generally, the county’s assessed value is approximately 20% below market value (1,050,000 / 1.2 = $875,000). In 2021, the property was assessed at $827,000, which was almost 21% below the 2020 purchase price of $999,995. The new Buyer may consider protesting the assessed value to lower their property taxes (see How to Appeal the Assessed Value of Your Property).

Conversely, I’m also seeing some new listings in good neighborhoods that are presented well and priced right receive multiple offers. For instance, a West Seattle home was listed in early February 2023 for $1,275,000 and received 5 offers after 5 days on market, and the purchase price escalated to $1,450,000. I wouldn’t have recommended escalating above $1,350,000 to a Buyer with conventional financing because it probably wouldn’t appraise, however, the winning offer was cash. That’s not a bad decision, if you’re aware of the premium you’re paying and plan to own the home for 5 or more years.

It's a good time to be a Buyer!

The ideal time to sell (list) a property is from now until mid-May. Keep in mind that it will take approximately 2 months to schedule contractors to prepare the property, if necessary, and stage it. Stagers are already booked 8 weeks out. I understand that any related sales expenses (e.g. brokerage fees, listing preparation costs, staging fees, etc.) can be deducted from your taxable gain. Please consult with your Certified Public Accountant (CPA) to confirm. See this article, Sold Your Home This Year? Consider Writing Off Some Common Expenses. Also, please be aware the Real Estate Excise Tax (REET) increased as of January 1, 2023 (ref: https://dor.wa.gov/taxes-rates/other-taxes/real-estate-excise-tax, see What rate do I pay?).

I’m here to help you or someone you know with their real estate goals.